Eligible employees of UAB, UAB Hospital, and UAB Hospital Management LLC must choose or decline health care coverage during the annual open enrollment Oct. 25-Nov. 11. In addition to the consumer-driven health plan Viva Choice, the traditional health plans from Viva Health and Blue Cross/Blue Shield (BCBS) are available for 2020. Employees also may opt to secure dental and vision benefits through separate plans offered.

Eligible employees of UAB, UAB Hospital, and UAB Hospital Management LLC must choose or decline health care coverage during the annual open enrollment Oct. 25-Nov. 11. In addition to the consumer-driven health plan Viva Choice, the traditional health plans from Viva Health and Blue Cross/Blue Shield (BCBS) are available for 2020. Employees also may opt to secure dental and vision benefits through separate plans offered.

This is an active enrollment, which means any benefit-eligible employee who does not select a 2020 health care plan option during the enrollment period will not have UAB-provided health care coverage (medical, dental, vision) beginning January 2020.

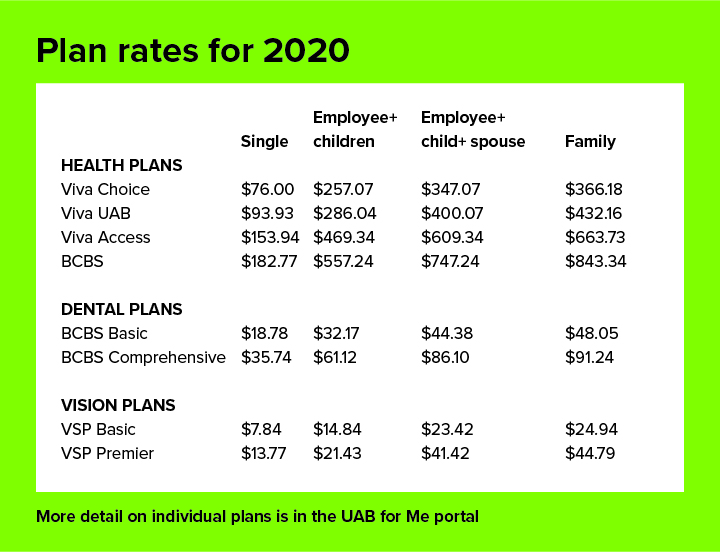

Health plan rates

The cost of medical premiums has continued to rise nationally during the past decade, and UAB has faced the same challenge as many other large employers: to provide a choice of high-quality health care coverage at a cost both the individual and the institution can afford. Chief Human Resources Officer Alesia Jones says the benefits team has met that challenge; for all UAB’s health care plan offerings, excepting VIVA UAB, there will be no increase to single, employee plus children and family tiers again this year.

“During the past five years, the UAB Benefits office and employee-led Benefits Committee have worked diligently to increase choice, expand coverage and contain costs for their colleagues and the institution while reducing projected deficits,” Jones said.

“Other than the transitional tiers, the committee has generally been able to keep rates flat for the self-insured medical plans, dental and vision insurance, improve the pharmacy benefit, offer premium assistance for eligible employees and introduce voluntary benefit options, including employee wellness,” Jones said. “In the national landscape, this is no small feat, and we appreciate their hard work.”

Final year for transitional tiers

No plan design changes have been implemented for 2020; however, a change in the tier structure that was announced in 2017 is being continued that may affect employees whose spouses are covered through their UAB benefits.

Other than single and family coverage, UAB plans historically offered an additional tier — employee plus up to 2 — which could accommodate a spouse, two children, one child, or a spouse and one child for the same premium rate. In the planned restructuring, the employee plus up to 2 tier became employee plus children, regardless of the number of children covered, and spousal coverage would only be provided under the family tier. Because of the additional cost to some employees covering a spouse, a fourth, temporary transitional tier was created — employee plus spouse, or employee plus spouse plus one child — to ease the transition to family tier.

The 2020 calendar year is the final year the transitional tier will be available. Refer to the chart for rates based on tier selection and selected provider.

Priority access for employeesOne benefit of working in a world-class medical center is ease of access to the best possible care.UAB Medicine has initiated a program to help all UAB and UAB Medicine and employees and their spouses and dependents connect with its caregivers. Dedicated appointment and nursing specialists are available to assist you with access to office visits, UAB eMedicine, Urgent Care, myUABMedicine patient portal, LiveChat and more. Call 205-975-4YOU (4968) or visit uabmedicine.org/4YOU to learn more or get started. |

Premium assistance returns

To ease the cost of medical premiums for qualified employees, UAB offers a premium-assistance program for eligible employees on a UAB health plan. This year the subsidy is available to employees whose household income, based on family size, is two (2) times the federal poverty level or less.

Those who qualify would be eligible for a fixed amount each payroll for the 2020 plan year — equivalent to the cost of single employee insurance through Viva Choice, according to UAB Executive Director Benefits and Wellness Mike Boyd.

Vision and dental plans

UAB offers its stand-alone vision benefit through Vision Service Plan, which provides coverage for routine eye exams, lenses and frames, contacts — both in and outside its network — plus discounts for LASIK eye surgery (in-network only) and other special discounts to plan members. Employees also may choose basic coverage or a premier plan option that includes new replacement frames every year.

UAB offers eligible employees a choice of two stand-alone dental plans — basic or comprehensive coverage provided by Blue Cross Blue Shield of Alabama.

Refer to the chart for rates based on tier selection and plan options.

Need help?

All the information employees need to make their selections will be collected in the open enrollment toolkit in the UAB for Me benefits portal. This includes plan details, educational pieces, FAQs, decision-making tools and other resources that can help you make selections.

Employees who want assistance sorting through the options have several choices to help them select the one best suited for their household:

-

A plan-shopping application is available during the online open enrollment process.

-

Human Resources representatives will answer questions during UAB Benefits Fair 7 a.m.-4 p.m. Oct. 31 in the UAB Hospital West Pavilion Atrium.

-

HR Consultants or HR Benefits Representative are available in individual schools/departments for your convenience.

-

Employees may contact their HR consultant or the UAB Benefits office, benefits@uab.edu or 934-3458.

All elections will be effective Jan. 1, 2020, and new premiums for medical, dental and vision coverage will be reflected in the January 2020 payroll.

More on open enrollment:

Information about benefit options is being provided to better enable you to make the best choices for your household.

Information about benefit options is being provided to better enable you to make the best choices for your household.Previous:

5 things to know about open enrollment

Consumer-driven health plan continues to grow in favor

3 traditional health plan options are available for 2020

Dental coverage is available from BCBS

Next: 9 ways to reduce your health care costs in 2020