Written by UAB Magazine

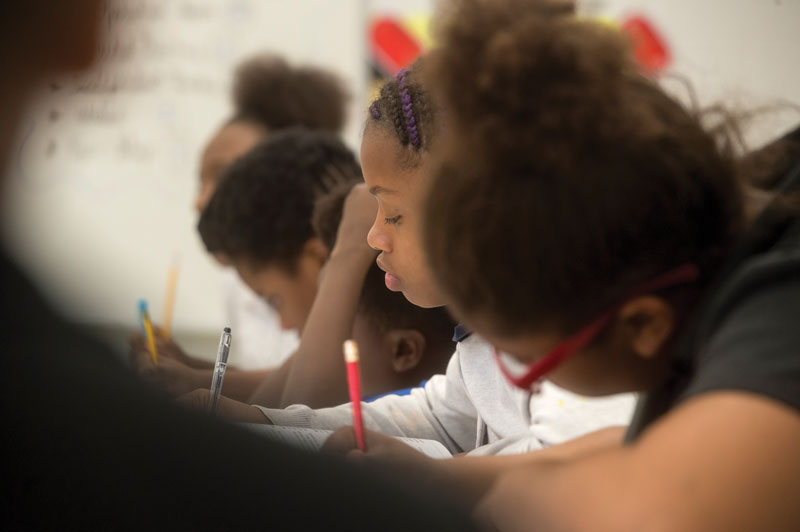

Stephanie Yates introduces the basics of budgeting, saving, and other money matters to students at Birmingham's Putnam Middle School.Last summer, UAB student Brandon Pickett worked as a lead counselor in a camp where the kids learned survival skills—the kind involving dollars and cents. During the four-day Money Math Camp, he and other counselors taught 45 middle-schoolers from low-income and minority school districts about money management and the impact of career choices on future lifestyles.

Stephanie Yates introduces the basics of budgeting, saving, and other money matters to students at Birmingham's Putnam Middle School.Last summer, UAB student Brandon Pickett worked as a lead counselor in a camp where the kids learned survival skills—the kind involving dollars and cents. During the four-day Money Math Camp, he and other counselors taught 45 middle-schoolers from low-income and minority school districts about money management and the impact of career choices on future lifestyles.

“As a kid, I was never taught the importance of saving and investing and other financial tools needed for success,” says Pickett, who is pursuing a master’s degree in business administration. The camp, he says, offers an opportunity to guide and mentor the next generation so that it can capitalize on that invaluable knowledge throughout their lives.

The Money Math Camp is one facet of the Regions Institute for Financial Education at UAB, a bold and broad effort to help people successfully manage their personal finances by learning the skills and knowledge essential to that task. Regions Bank provided a gift to the UAB Collat School of Business to create and support the institute. Now the two are partnering to organize programs for K-12 students as well as UAB students, employees, and the Birmingham community.

A financial education center is an important resource for a growing community, says Stephanie Yates, Ph.D., institute director and UAB associate professor of finance. “Here, families and individuals can get answers in one place from credible sources,” she explains.

Building piggy banks

The institute dispenses useful, practical information tailored to each stage of life. Grade-school children love learning the basics of money through hands-on activities, Yates says. “They get to handle money, build piggy banks, and do some role-playing involving money decisions,” she notes. “College students want to know about credit, debt, and investing. Adults want to know how to send their kids to college and prepare for retirement.”

In the classroom, the institute and Regions focus on college and career readiness. They have partnered with Birmingham City Schools to provide financial education to approximately 3,500 students over seven years through the Pathways to Success program. Working with GEAR UP Alabama and GEAR UP Birmingham, they will reach approximately 9,500 students throughout the city and Alabama’s Black Belt over seven years through programs such as the Money Math Camp. Even teachers can take part through sessions designed to help them better explain financial topics to high-school students.

On campus, UAB students, athletes, faculty, and staff can participate in Financial Education Boot Camps, one- to two-hour workshops on topics such as paying for college, budgeting, and basic investing. Future courses will help students understand financial topics relevant to their majors.

The public has explored saving and budgeting at sessions hosted by the institute at the Birmingham Public Library. “We are trying to reach as many people as possible to provide them with the knowledge they need in order to be financially successful,” says Jackie Russell, J.D., instructor in the UAB Department of Accounting and Finance.

Organizers envision the center becoming a nationally known personal finance resource, with research to evaluate the immediate and long-term outcomes of its programs, Yates says. Currently, Yates is studying gender differences in financial education delivery, based on research conducted during last summer’s Money Math Camp. Her findings will help to shape the design and implementation of future financial education programs.

Immediate impact

For Collat School of Business faculty, the opportunity to share financial expertise with the community represents a chance to make an immediate impact. “There are a lot of people who manage their finances based on what they heard from somewhere or what someone told them, and the institute provides a venue to help clear up some of those misunderstandings,” Russell says. “I want to teach people the power of the money that they already have. Everyone wants more money, but for most, there is a process to get there. So you have to learn to manage a budget, manage your credit, understand the impact of student loans, understand why you would invest in your 20s, and so forth.”

The institute “shows the importance of the community working together to produce responsible future members of society,” adds Elizabeth Turnbull, a UAB business instructor who teaches financial lessons to K-8 students. “Hopefully, by starting with the younger members of the community, we can help them practice good money management, and they will teach others to do so as well. Students will see how important this topic is in their lives, both now and in the future.”