Blazer Home Neighborhood Living Initiative

At the University of Alabama at Birmingham, we understand that the continued success of our institution is linked to that of the surrounding community. That's why UAB leads Alabama universities in assisting employees with home purchases through the Blazer Home Neighborhood Living Initiative.

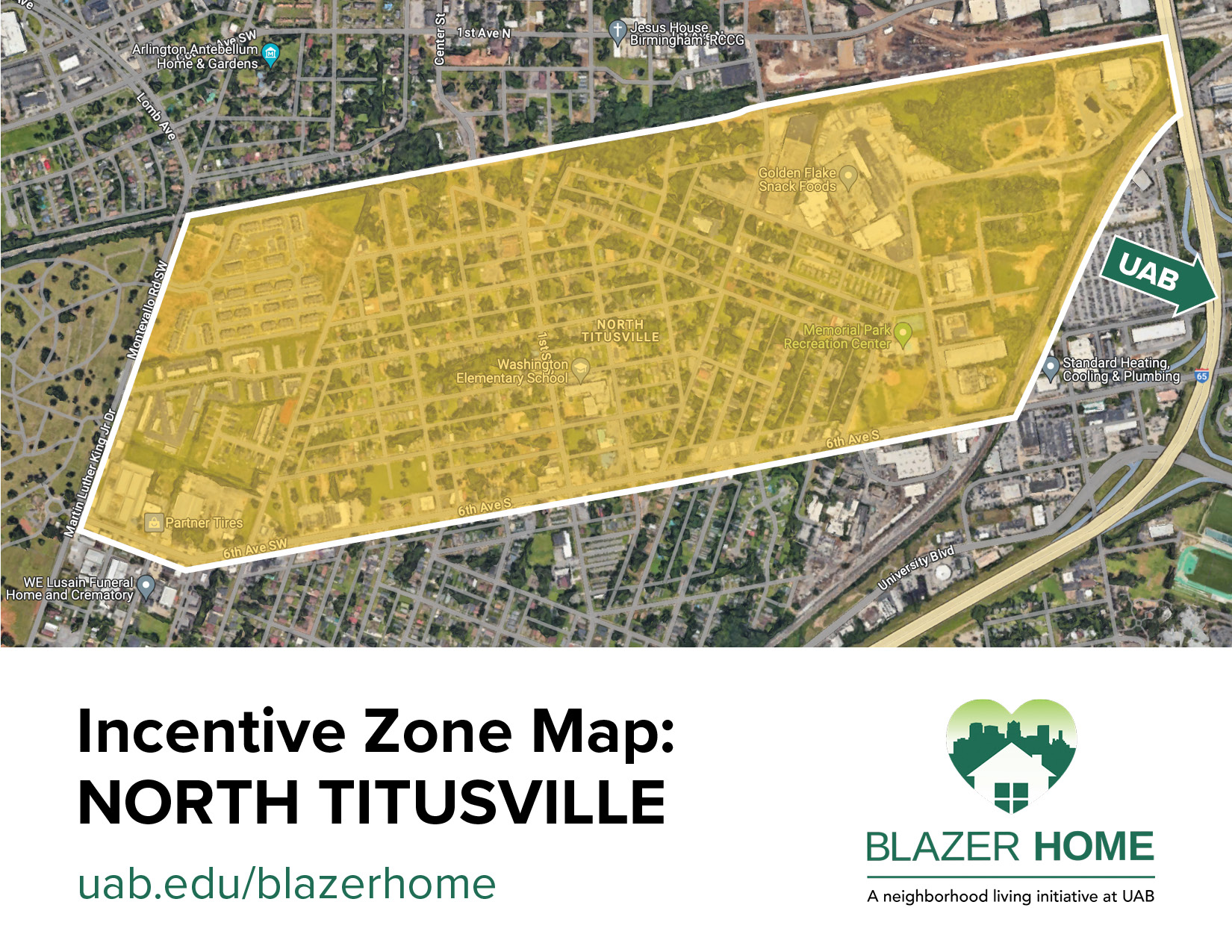

Blazer Home offers assistance to full-time, benefits-eligible faculty and staff purchasing a primary residence in designated areas of the Titusville neighborhood in Birmingham. The five-year conditional grants, funded by the UAB Educational Foundation, may be used for a down payment and/or closing costs for the purchase of a home in the incentive zone. Select a tab below to learn more.

- About Blazer Home

- Eligibility

- How to Apply

- Search Land Bank Properties

- City Councilor

- Available Assistance

-

About Blazer Home

The Blazer Home Neighborhood Living Initiative provides five-year grants up to $15,000 to be used for the down payment and/or closing costs for purchasing a primary residence in the designated incentive zones in the North Titusville neighborhood.

Terms of Agreement

- Presentation of a purchase agreement is required for any grant, which may only be used to purchase a single-family home, townhome or condominium within the zones set forth by this program.

- The employee-homeowner must commit to residing in the home for at least 60 months following the award of the grant (“minimum occupancy requirement”). The University may reclaim a prorated portion of the grant award from any employee- homeowner who fails to meet the minimum occupancy requirement

- The employee-homeowner agrees to provide 60 months of continual service to UAB following the award of the grant concurrent with the minimum occupancy requirement. The University may reclaim a prorated portion of the grant award from any employee-homeowner who separates from employment with the University prior to the completion of 60 months of continual service, except in the following instances:

- Death of the employee

- Retirement due to disability of the employee

- Termination of the employee due to reduction in staff

- Assistance is limited to one award per household (in an amount up to $15,000) for the lifetime of the program.

- This home-ownership assistance grant is considered income to the employee and the employee-homeowner is responsible for any related income tax liability. Each year the employee will be sent a Form 1099-MISC for one-fifth of the grant amount during the five-year term, which represents the amount each year that can no longer be reclaimed by the University under the minimum occupancy requirement.

- First-time homebuyers must participate in the Steps to Home Ownership Course through the Campus Learning System. The financial workshop for first-time home buyers has two components.

- An online assessment to educate on home-buying (required)

- Personal counseling with the Regions Institute for Financial Education (RIFE) to help clear any issues, create a budget, and introduce other principles of personal financial management (as needed)

Grant is prorated over a 5-year period as follows:After 1 Year After 2 Years After 3 Years After 4 Years After 5 Years $12,000 Owed $9,000 Owed $6,000 Owed $3,000 Owed $0 Owed Recipients are not required to repay any remaining balance of the grant as a result of the employee's death, retirement due to disability or termination due to reduction in staff.

-

Eligibility

In order to participate in the Blazer Home Neighborhood Living Initiative, applicant must meet the following criteria:

In order to participate in the Blazer Home Neighborhood Living Initiative, applicant must meet the following criteria:Employee Eligibility

- Must be a full-time, benefits-eligible, UAB, UAB Hospital, or UAB Hospital Management, LLC employee.

- Employee must be purchasing a primary residence in the incentive zones.

- Employee must be qualified for a mortgage through an approved lender.

Property Eligibility

- The residence must be located in the geographical boundaries of the incentive zones of the Titusville neighborhood adjacent to campus (click map to expand).

- The property must be a single-family home, townhome or condominium.

- The property must be owner-occupied by the employee for the five-year term of the grant.

- Second homes, vacation homes, mobile homes, investment properties, homes for dependents and non-dependents, and life care facilities are not qualifying residences. A participant must occupy the qualifying residence as his or her primary residence.

- Grant funds cannot be used for the purchase of land for new construction.

-

How to Apply

With just a few steps, full-time, benefits-eligible UAB, UAB Hospital and UAB Hospital Management, LLC employees can apply for assistance with the Blazer Home program to help with the purchase of a new home within the designated incentive zones.

Blazer Home Application

Step 1- Research the designated neighborhoods and select a home anywhere within the incentive zone. Eligible properties must be the primary residence of the homebuyer, be occupied by the homebuyer, be located within the incentive zone, and must be a single-family home, townhouse or condominium.

- First-time homebuyers must participate in the Steps to Home Ownership Course.

- Begin the process of buying your home. A mortgage loan approval must be obtained prior to receiving a loan from the Blazer Home Program; pre-qualification by a lender is strongly encouraged prior to signing a contract of sale. A home inspection is also recommended.

Step 2

- Download an application for the Blazer Home Program above. Complete the application and submit paperwork via email to blazerhome@uab.edu.

- The approval committee will review all applications that meet the program criteria. You will be notified if your application is approved.

-

Search Land Bank Properties

The Birmingham Land Bank Authority strives to empower citizens of Birmingham to take charge of their neighborhoods in the battle against blighted, overgrown and abandoned properties. Through the BLBA General Request program, citizens can reclaim and renovate eligible tax-delinquent properties through the quiet title process to work towards achieving full ownership of properties.

-

City Councilor

DISTRICT 6: Crystal N. Smitherman

DISTRICT 6: Crystal N. SmithermanCouncilor Crystal N. Smitherman is the city councilor for North and South Titusville, as well as Arlington West End, Cooper Green Homes, Glen Iris, Graymont, Mason City, Loveman Village, Oakwood Place, Powderly, Smithfield, West End Oark, Woodland Park. Smitherman is chair of the Budget and Finance Committee, and a member of the Arts & Culture and Planning & Zoning Committees.

-

Additional Assistance

Other forms of financial assistance for homebuyers are available through lenders and government-issued grants and loans listed below. Eligibility varies by income, occupation and location. Use of any of these programs will not affect your ability to participate in UAB’s Blazer Home initiative. This list is not exhaustive, and more providers will be listed as information becomes available.

Down-payment Assistance

- Step Up: This down-payment assistance program from the Alabama Housing Finance Authority is available to participants who earn less than $97,300, regardless of household size or location.

- Neighborhood Lift: This down-payment assistance program from Birmingham Neighborhood Housing Services and WellsFargo provides eligible homebuyers with matching funds up to $7,500 in down-payment assistance on qualified properties in Jefferson County, Alabama.

Other Assistance

- Legacy Credit Union: The official credit union of UAB is partnering with UAB to offer services including 5/1 Adjustable Rate Mortgages, Fixed Rate Conventional Financing and Construction/Renovation Lending.

- Good Neighbor Next Door: This program from the US Department of Housing and Urban Development offers a 50 percent discount on the list price of single-family homes in revitalization areas to law enforcement officers, teachers, firefighters and emergency medical technicians. Check the listings.

- Historic Homeowners Grant Program: Low to moderate income owners of historic homes in the City of Birmingham are eligible for up to $35,000 in grant money for exterior maintenance and repairs that are in keeping with the historic character of the property.

- FHA Section 203(k) Loans: This HUD program enables homebuyers and homeowners to finance both the purchase of a house and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home.

- Mortgage Credit Certificate: MCCs provide a tax credit to reduce the amount of federal taxes owed by a percentage of the annual mortgage interest paid each year.