Dr. Sheryl LeAnn Perkins will join UAB Human Resources as Assistant Vice President — Benefits & Wellbeing, effective May 6, 2024.

Perkins has more than 25 years of experience planning and overseeing employee benefits programs, most recently as Associate Vice President for Benefits at Arkansas State University System (ASU), where she oversaw ASU's $10 million self-insured health plan fund. While managing the benefit and retirement programs for the ASU System, she was committed to keeping the benefits package competitive and affordable to employees and institutions. Additionally, she ensured compliance with federal regulations, oversaw annual enrollment processes, and developed new benefits programs while driving the establishment and execution of organizational objectives, policies, and protocols.

Perkins earned a Master of Business Administration (MBA) with an emphasis in Health Administration from William Woods University in Missouri, a Master of Public Health from AT Still University in Missouri, and a Doctorate in Health Administration from Capella University in Minneapolis, Minnesota.

— Posted April 5, 2024

Helping employees plan and save for the future is important. The University of Alabama System is pleased to announce updates to the voluntary retirement plans. The changes do not require you to take any action at this time. Here are some important things to know:

- Introducing Target Date Plus model portfolios

These new model portfolios, available through the TIAA RetirePlus Pro® service, will serve as the new default investment option for the plans, replacing the current age-based TIAA-CREF Lifecycle Index Institutional funds. The new Target Date Plus model service may make it easier to plan and save for retirement by providing you with a professionally managed model portfolio that will be rebalanced every 90 days. They are a convenient alternative to making and managing your own choices from the retirement plans’ investment lineups and offer an option for monthly income payments for life once you retire. - New TIAA accounts

As a part of the model portfolio enhancement, for those who do not already have one, a new plan account(s) with TIAA will be created for you. Your account access information will remain the same. - Share class changes

Some of the investment options will be replaced by a lower-cost share class of the same investments. - Program fee reduction

Fees are being reduced in an effort to help reduce the overall cost of participation in your retirement plan.

Make the most of your retirement benefits

The upcoming enhancements provide an excellent opportunity for you to revisit your retirement plan options. The TIAA Transition Guide with additional information was mailed to participants in early March 2024. Carefully review the guide for more details on key dates, specific action steps, upcoming informational webinars and resources available to you. You should be aware of the following dates for anticipated changes and events. No action is required at this time.

Key dates

|

Expected 2024 date |

Change/Event |

| March 19 | Live webinar session with Q&A at the end, 10-11 a.m. Click here to register. |

| March 21 | Live webinar session with Q&A at the end, 12-1 p.m. Click here to register. |

| March 27 | Pre-recorded webinar session with live Q&A at the end, 3-4 p.m. Click here to register. |

| March 18-29 | One-on-one session to schedule a retirement advice and education session with a TIAA financial consultant, visit TIAA.org/schedulenow or call 800-732-8353, weekdays from 7 a.m.-7 p.m. |

| On or about April 3 | Enrollment in new accounts as needed and subscription to the new Target Date Plus model service begins. |

| April 3-May 3 | Window for personalization of or unsubscribing from the model service. |

| First payroll in April | First contribution into the new model portfolio. |

| Week of May 6 | Existing balances transfer to the new accounts (if applicable) and model portfolio. |

If you have questions or need assistance throughout the upcoming transition, visit TIAA.org/uasystem (UAB), TIAA.org/uabllc (LLC), or call TIAA at 800-842-2252. Consultants are available every weekday from 7 a.m. to 9 p.m. Or contact the UAB Benefits Office.

— Updated March 6, 2024

PayFlex, UAB's provider for flexible spending accounts (FSA) and health savings accounts (HSA), is now Inspira Financial. The name change is effective as of January 17, 2024. This change should not affect service for UAB employees with an existing Payflex FSA or HSA account or who signed up for a Payflex FSA or HSA account during the Open Enrollment period.

Here is what you need to know...

- WEBSITE: As of January 17, 2024, the provider's new website is inspirafinancial.com. Anyone who visits payflex.com will be automatically redirected to the correct site. To login, click the yellow “Log in” button in the top-right corner of the screen, then select the yellow “Log in” button within the “Manage your HSA, FSA, or other benefits” box. If you created an online profile with PayFlex before January 17, 2024, your login credentials (username and password) will remain the same.

- MOBILE APP: The new Inspira mobile app is now available in the Apple App Store and Google Play Store. If you already have the PayFlex mobile app downloaded on your device, you will automatically be prompted to update it.

- CUSTOMER SERVICE: There is currently no change to the existing contact information for the PayFlex Customer Service Center. You may continue to contact customer service for your FSA/HSA account by calling 800-284-4885.

- DEBIT CARDS: Payflex debit cards will not be re-issued. Customers with a current PayFlex-branded debit card may continue to use their current card until the expiration date noted on the front. When your card expires, you will receive an Inspira-branded debit card.

More information about Inspira Financial services for UAB employees is available in the UAB for Me portal. For additional questions, contact the UAB Benefits Office.

— Posted February 13, 2024

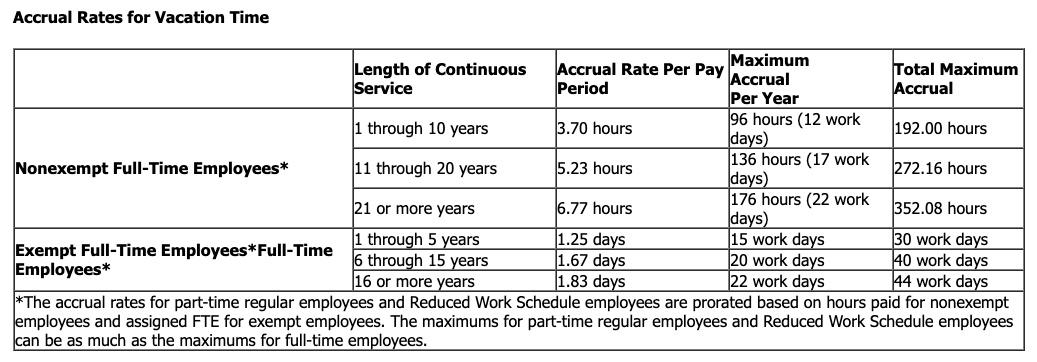

An extension on total maximum accrual of vacation time, allowing employees to carry up to three times their annual vacation accrual, is set to expire at the end of this year.

On December 31, 2023, the total maximum accrual will revert to two times the annual vacation accrual, and beginning January 1, 2024, any excess vacation will be converted to sick time to align with HR Policy 301: Vacation. See table below for accrual details.

Employees have been allowed to keep and roll over their unused vacation time under an extension approved by UAB and UAB Medicine in 2020, in response to pandemic-related restrictions on gathering and travel that made it difficult to use paid leave. As use of vacation time has returned to pre-pandemic levels, the policy exemption will expire as intended.

— Posted November 15, 2023