Overview

The University of Alabama at Birmingham’s Purchasing department values our vendors, which help supply goods and services to University personnel in support of their educational and research efforts. This section is designed to help both current and prospective vendors find answers to the most frequently asked questions and to provide resources to assist with vendor-related processes.

Prospective vendors begin their registration process via the UAB iSupplier portal. See the UAB iSupplier portal for more information.

-

UAB iSupplier Portal

The UAB iSupplier Portal contains a link to the portal, links to required documents, and registration information for both current and prospective UAB suppliers.

-

Electronic Bid Bulletin Board

The Electronic Bid Bulletin Board is the official listing of all active UAB solicitations for both the Hospital and University.

-

Purchase Orders

In Purchase Orders you will find UAB purchase order terms and conditions.

-

Receiving

In Receiving you will find shipping instructions for the UAB campus.

-

Invoicing

Invoicing describes invoicing requirements for suppliers doing business with UAB.

All* UAB vendors are required to register through UAB iSupplier, an online vendor portal that enables suppliers the ability to maintain purchasing and accounts receivable address(es) and contact information as well as retrieve UAB purchase orders.

The FIRST step in the registration process is to complete the iSupplier Registration Request. Upon review, the vendor will receive instructions for completing the registration process.

UAB vendors are eligible for RFQ (Request for Quotation) status. RFQ status enables the vendor to receive future bid solicitations for the commodity or non-professional service indicated on the bid classification form submitted as part of the iSupplier registration.

With iSupplier login credentials, it is the supplier/individual(s) responsibility to maintain contact information and required forms to do business with UAB.

NOTE: the tax form (W-9 / W-8) is provided one time unless something changes. The Vendor Disclosure Statement needs to be recertified on an annual basis.

Direct questions to uabisupplier@uab.edu.

Find vendor information (i.e. locating vendors and vendor status inquiries) for UAB departments.

NOTE: UAB Purchase Orders may be retrieved via iSupplier; however, the invoice submission function is currently unavailable. Invoices may be sent to uabapinvoices@uab.edu.

NOTE: iSupplier is not compatible with the Safari web browser.

*Patient and other refunds, petty cash, and study participants are exempt from registering through UAB iSupplier. Learn about the setup process.

-

Sales Tax Status

Learn more about UAB's tax exempt status.

-

Tax Services

UAB Tax Services strives to monitor and facilitate compliance with federal, state, and international tax laws that affect the University.

-

Collecting and Remitting Sales Tax

Learn more about collecting and remitting sales tax.

Delivery

UAB has several receiving entities; therefore, vendors must pay close attention to the instructions given on each order. Packing slips must show the purchase order number, item description, and quantity to correspond with the information on the purchase order. When this information is included on both the packaging slips and the invoices, it will help prevent lost time in identifying and accepting your products and will ensure prompt payment.

Invoicing

All invoices must reference the purchase order number. The item description, quantity, and unit prices must appear as shown on the purchase order or its latest amendment. Vendors are required to submit their invoices with a valid purchase order number to:

The University of Alabama at Birmingham

Accounts Payable Department

660 Administration Building

1720 2nd Ave S

Birmingham, Alabama 35294-0106.

Invoices not showing a valid UAB purchase order number will be returned to the vendor. For additional information about invoices and payment of invoices, please contact the Accounts Payable Department at (205) 934-4146.

Purchasing Goods

- Learn more about UAB's Sales Tax Status and download the Tax Exemption Certificate

- Download IRS Determination Letter

Note: The UAB Alabama Sales - Use Taxes Exemption Certificate does not cover purchases made using agency funds (i.e. Oracle account numbers with a balancing segment beginning with "9"). Purchases made using agency funds are required to pay the assessed sales tax unless a sales tax exemption notice from the State of Alabama is on file in the UAB Tax Services office.

Sales tax exemption is assessed according to the delivery destination; therefore, goods shipped outside the State of Alabama require that UAB have a valid sales tax exemption in the state to which the goods are delivered. To determine if a valid sales tax exemption certificate exists for a specific state, contact the UAB Tax Services office.

Selling Goods

UAB is responsible for collecting and remitting sales tax on the sale of tangible personal property in accordance with specific provisions of the Alabama Sales and Use Tax Rules (Rule 810-6-2-.88.03).

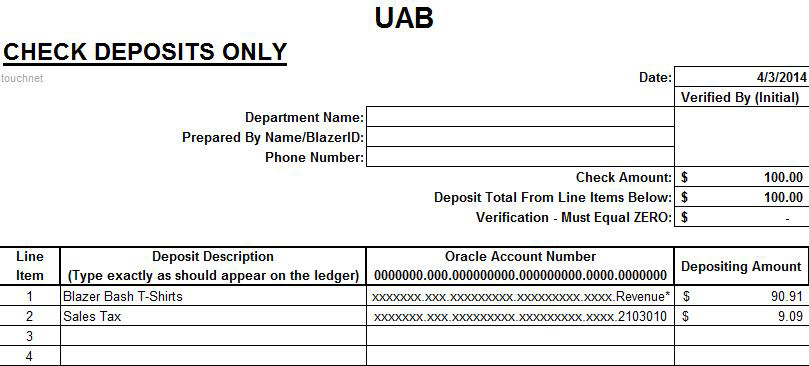

Sales tax must be collected at the point of sale and the appropriate liability entry included on the deposit form using object code 2103010. Failure to collect the sales tax from the buyer may result in the UAB department being required to cover the liability.

The method for calculating sales tax is dependent on the way a good is advertised which is covered in the Alabama Sales and Use Tax Rules (Rule 810-6-4.20).

- Cost Plus Sales Tax: Sales price stated without reference to sales tax must collect sales tax in addition to the sales price. The customer shall be furnished with a receipt showing sales tax separately stated if requested.

- Cost Including Sales Tax: Sales tax included in the purchase price of the tangible personal property sold must be disclosed.

Example: Selling a t-shirt for $10:

- Cost plus sales tax:

- Revenue (sales price of t-shirt = $10

- Sales Tax (10%) = $1

- Total Deposit = $11

- Cost including sales tax:

- Revenue (sales price of t-shirt = $9.09

- Sales Tax (revenue calculated x 10%) = $.91

- Total Deposit = $10

The UAB Tax Services department is responsible for the remittance of sales tax to the appropriate taxing authorities.

New Account

Contact General Accounting to set up a new account request. Revenue must be deposited to the same account from which the item or event was paid.

Purchases

Purchases of items are generally tax exempt. Refer to the Expenditure Guidelines Matrix for assistance identifying the appropriate method of payment for common university expenditures.

What is the Sales Tax Rate?

The Sales Tax Rate is 10% (4% State, 4% City, 2% County).

How do I make a deposit?

Collecting Sales Taxes should be done in conjunction with the deposit of funds. It is appropriate to separate out the sales tax portion with object code 2103010. Please use the correct form to prepare deposits (Cash Receipt – Cash, Check or Credit Card) for transactions remitted to either General Accounting or the Cashier’s Office.