Purchasing Goods

- Learn more about UAB's Sales Tax Status and download the Tax Exemption Certificate

- Download IRS Determination Letter

Note: The UAB Alabama Sales - Use Taxes Exemption Certificate does not cover purchases made using agency funds (i.e. Oracle account numbers with a balancing segment beginning with "9"). Purchases made using agency funds are required to pay the assessed sales tax unless a sales tax exemption notice from the State of Alabama is on file in the UAB Tax Services office.

Sales tax exemption is assessed according to the delivery destination; therefore, goods shipped outside the State of Alabama require that UAB have a valid sales tax exemption in the state to which the goods are delivered. To determine if a valid sales tax exemption certificate exists for a specific state, contact the UAB Tax Services office.

Selling Goods

UAB is responsible for collecting and remitting sales tax on the sale of tangible personal property in accordance with specific provisions of the Alabama Sales and Use Tax Rules (Rule 810-6-2-.88.03).

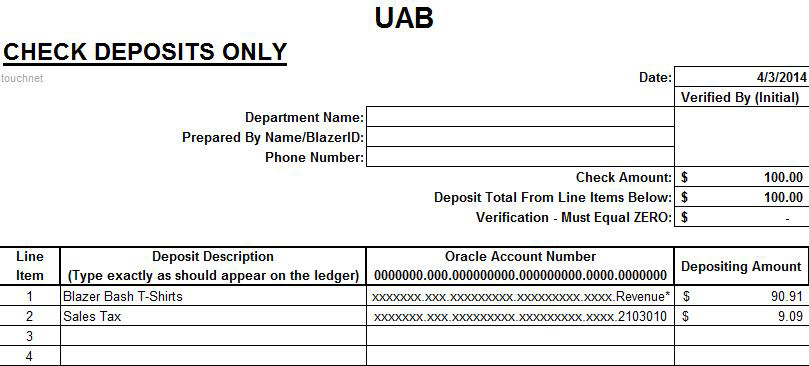

Sales tax must be collected at the point of sale and the appropriate liability entry included on the deposit form using object code 2103010. Failure to collect the sales tax from the buyer may result in the UAB department being required to cover the liability.

The method for calculating sales tax is dependent on the way a good is advertised which is covered in the Alabama Sales and Use Tax Rules (Rule 810-6-4.20).

- Cost Plus Sales Tax: Sales price stated without reference to sales tax must collect sales tax in addition to the sales price. The customer shall be furnished with a receipt showing sales tax separately stated if requested.

- Cost Including Sales Tax: Sales tax included in the purchase price of the tangible personal property sold must be disclosed.

Example: Selling a t-shirt for $10:

- Cost plus sales tax:

- Revenue (sales price of t-shirt = $10

- Sales Tax (10%) = $1

- Total Deposit = $11

- Cost including sales tax:

- Revenue (sales price of t-shirt = $9.09

- Sales Tax (revenue calculated x 10%) = $.91

- Total Deposit = $10

The UAB Tax Services department is responsible for the remittance of sales tax to the appropriate taxing authorities.

New Account

Contact General Accounting to set up a new account request. Revenue must be deposited to the same account from which the item or event was paid.

Purchases

Purchases of items are generally tax exempt. Refer to the Expenditure Guidelines Matrix for assistance identifying the appropriate method of payment for common university expenditures.

What is the Sales Tax Rate?

The Sales Tax Rate is 10% (4% State, 4% City, 2% County).

How do I make a deposit?

Collecting Sales Taxes should be done in conjunction with the deposit of funds. It is appropriate to separate out the sales tax portion with object code 2103010. Please use the correct form to prepare deposits (Cash Receipt – Cash, Check or Credit Card) for transactions remitted to either General Accounting or the Cashier’s Office.