Account Key

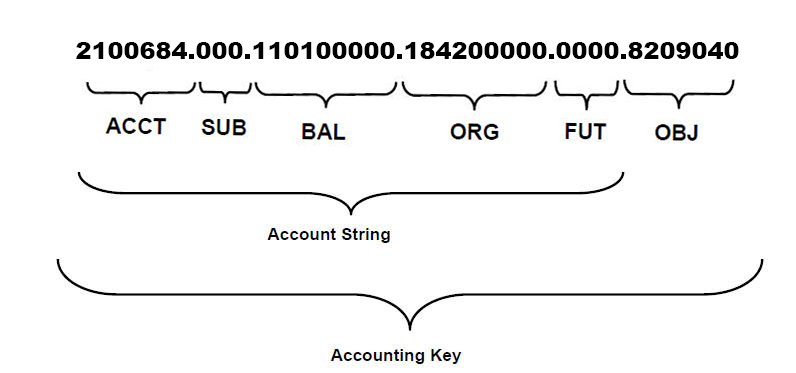

In the General Ledger, transactions are posted to an "Accounting Key" consisting of six segments:

- Account (ACCT),

- Subaccount (SUB),

- Balancing (BAL),

- Organization (ORG),

- Future (FUT), and

- Object Code (OBJ).

The first five segments are known as the "Account String." Therefore, an Accounting Key is comprised of an Account String plus an Object Code.

The first five segments of the accounting key are also referred to as the account string or the ASBOF (Account, Subaccount, Balancing, Organization, and Future) — that is, the first five segments without the object code. The remaining segment is the Object Code.

Note: When writing the accounting key, a decimal separates each segment of the accounting key.

Example

- Accounting Key: 2100684.000.110100000.184200000.0000.8209040

- Account String: 2100684.000.110100000.184200000.0000

- ACCT: 2100684

- SUB: 000

- BAL: 110100000

- ORG: 184200000

- FUT: 0000

- OBJ: 8209040

To assist in entry of the accounting key in Oracle, you will frequently see a screen similar to the one below. There are lists of values (LOVs) available for each field to aid in the search process. As you select each segment from the LOV or type each segment directly into the field, a description of that segment will appear to the right of the number selected. In this format, the decimals between each segment are implied so that you do not have to type them.

The Account (ACCT) segment is the first segment of the GL accounting key. The Account segment consists of seven numeric digits and identifies the primary activity for which money is being spent.

The first digit of this seven-digit segment is earmarked to represent specific types of account strings.

Note: Account segments starting with 6, 8, or 9 are GA/GL Recap accounts.

Account Segments: Balance sheets |

Identify a primary activity of: |

|---|---|

|

0xxxxxx |

Balance sheets, University and Hospital |

Account Segments: Income statements |

Identify a primary activity of: |

|---|---|

|

1xxxxxx |

University revenue-only income statements |

|

2xxxxxx |

University expenses-only income statements |

|

3xxxxxx |

University mixed revenue/expenses income statements |

|

4xxxxxx |

University - reserved for future mixed revenue/expenses income statements |

|

5xxxxxx |

University mixed revenue/expenses income statements |

|

6xxxxxx |

GA Plant project GA/GL Recap income statements |

|

7xxxxxx |

Hospital revenue/expenses income statements |

|

8xxxxxx |

GA Grant-Related Income, Mandatory Cost Sharing, and Student Financial Aid GA/GL Recap income statements |

|

9xxxxxx |

GA sponsored grant projects GA/GL Recap income statements |

There is no further blocking for University Account segment values. UAB Financial Affairs utilizes the Oracle processes to assign all University Account values in sequential order within each prefix (i.e., except for the first digit, there is no blocking for University Account values).

Account Segment (Hospital)

In addition to the institution-wide standard one-digit prefix, the Hospital will also utilize the second and third digits of the Account segment to further define the type of accounting activity as follows:

- First number of account segment: Account Segment Prefix

- Second number of account segment: Hospital Blocking Code

- Third number of account segment: Hospital Activity Group

Hospital Blocking Code

- 1 — Other Unrestricted

- 2 — Unrestricted Self-supporting

- 4 — Restricted (including all endowments)

- 5 — Debt

- 6 — Plant Project Funding

- 7 — Assets

- 8 — Capital Equipment Purchase

Hospital Activity Group

- 1 — Routine

- 2 — Ancillary

- 3 — Discounts/Capitation

- 4 — Patient Support

- 5 — Other Operating

- 6 — Administrative

- 7 — Financial

- 9 — Non-operating

To ensure the integrity of their internal blocking, Hospital Finance assigns all Hospital Account values. There is no range blocking in the remaining digits of the Account segment.

The third segment of the new GL accounting key is the Balancing (BAL) segment. It consists of nine numeric digits and will track activities for which UAB may need a balance sheet, whether for internal or external purposes.

The Balancing segment is used to match revenues to expenses, track spending restrictions and designations, categorize UAB's net assets for external reporting, and define the carry forward of year-end balances. The balance sheet represents a report grouping, with assets, liabilities, and net assets (also known as a fund balance, equity, retained earnings, etc.). Separate balance sheets are maintained to satisfy the need for adequate stewardship in accordance with the requirements of donors, trustees, granting agencies, or other internal management purposes. The balance sheets are aggregated for audited financial statement purposes. Listed below are examples of how the Balancing segment would be relevant:

- To identify Hospital's General Operating Funds vs. UAB Heersink School of Medicine's General Operating Funds

- To separately account for a restricted gift.

- To separately account for an endowment.

- To separately account for the receipt and use of a grant sponsor's award.

For accounting activity managed in the Oracle General Ledger, the Balancing segment of a GL income statement account string indicates the balance sheet to which that account string is related. For a GL balance sheet account string, the Balancing segment uniquely identifies the specific balance sheet. For income statements, the Balancing segment value is always identical to the Balancing segment value of the balance sheet account string to which it relates. The first two digits of the Balancing segment indicate the internal functional grouping.

Segment Values

General Operating 100000000 - 199999999

- 110000000 - 119999999: Central General Operating Accounts

- 120000000 - 129999999: Academic General Operating Accounts

- 130000000 - 139999999: Hospital General Operating Accounts

- 140000000 - 149999999: Auxiliaries General Operating Accounts

Other Unrestricted 200000000 - 299999999

- 210000000 - 219999999: Misc. Unrestricted Accounts

- 250000000 - 259999999: Unrestricted Endowment Earnings/Spending Accounts

- 290000000 - 299999999: Professional Service Funds

Student Loan 300000000 - 399999999

- 310000000 - 319999999: Federal Student Loan Funds

- 320000000 - 329999999: Nonfederal Student Loan Funds

Other Restricted 400000000 - 499999999

- 410000000 - 419999999: Restricted Gift Accounts

- 420000000 - 429999999: Misc. Restricted Accounts

- 450000000 - 459999999: Restricted Endowment Earnings/Spending Accounts

- 480000000 - 489999999: Grant-Related Income GAGL Recap Accounts

- 490000000 - 499999999: Grant Mandatory Cost Sharing GAGL Recap Accounts

Endowment 500000000 - 599999999

- 510000000 - 519999999: Pure Endowments

- 520000000 - 529999999: Term Endowments

- 530000000 - 539999999: Independent Quasi-Endowments

- 540000000 - 549999999: Quasi-End Related To Pure

- 550000000 - 559999999: Quasi-End Related To Term

- 560000000 - 569999999: Quasi-End Related To Independent Quasi

Grant 600000000 - 699999999

- 600000000 - 609999999: Federal Student Financial Aid Grants GAGL Recap Accounts

- 610000000 - 619999999: Federal Gov't Grants & Contracts GAGL Recap Accounts

- 620000000 - 629999999: State Gov't Grants & Contracts GAGL Recap Accounts

- 630000000 - 639999999: Local Gov't Grants & Contracts GAGL Recap Accounts

- 640000000 - 649999999: Private Grants & Contracts GAGL Recap Accounts

Annuity & Life Income 700000000 - 799999999

- 710000000 - 719999999: Annuity Funds

- 720000000 - 729999999: Life Income Funds

Plant 800000000 - 899999999

- 820000000 - 829999999: General B&E Reserves

- 830000000 - 839999999: Funded Depreciation Reserves

- 840000000 - 849999999: Trusteed Construction Funds

- 850000000 - 859999999: University Capital Plant Projects (Hospital 837001500)

- 880000000 - 889999999: Plant Asset Accounts

- 890000000 - 899999999: Plant Debt Accounts

Agency 900000000 - 999999999

- 900000000 - 909999999: Hospital Agency Funds

- 990000000 - 999999999: University Agency Funds

One-to-one Relationships

The remaining seven digits of the Balancing segment value must be the same as the Account segment if a one-to-one relationship exists between the income statement and balance sheet account strings. Also, both the Organization and Balancing segment values must match between the two account strings.

Example of a one-to-one relationship:

- 3100022.000.213100022.446001234.0000: Income Statement

- 0000000.000.213100022.446001234.0000: Balance Sheet

Many-to-one Relationships

A many-to-one relationship exists when several income statements roll up to one balance sheet. If a many-to-one relationship exists between the income statements and balance sheet (such as in the case of a Dean's office balance sheet which includes several general operating funds accounts), then the remaining seven digits of the Balancing segment will not be the same as the Account segment.

Example of a many-to-one relationship:

- 1012345.000.110100000.114102000.000: Income Statement

- 1987654.000.110100000.114102000.000: Income Statement

- 0000000.000.110100000.114102000.000: Balance Sheet

Stand-alone Balances

In limited cases, a balance sheet account string will have no related income statement account strings at all. This relationship is known as a "stand-alone balance sheet," and is not permitted except in the Central and Hospital general operating funds.

The fifth segment of the new GL accounting key is the Future (FUT) segment. The FUT segment has been reserved to meet any future requirements UAB may have that necessitate the expansion of the GL accounting key.

Having a future use segment will result in minimal work to be done if a subsequent event arises causing the need for an additional accounting key segment. The Future segment consists of four numeric digits and defaults to 0000.

The sixth and final segment of the GL accounting key is the Object Code segment. It consists of seven numeric digits representing the natural account classification.

The Object Code categorizes the nature of dollars as a specific type of revenue, expense, asset, etc. The Oracle system requires that this be a segment in the accounting key.

Object Code Segment Blocking

UAB has blocked certain ranges of Object Code segment values to represent specific account classifications. The first digit of the Object Code segment specifies the major range and identifies the major financial reporting categories (Example: assets, liabilities, revenues, expenses, etc.).

Balance Sheet

- Assets: 1000000 - 1999999

- Liabilities: 2000000 - 2999999

- Balance: 3000000 - 3999999

Income Statement

- Transfers In & Out: 4000000 - 4999999

- Revenues: 6000000 - 6999999

- Expenses: 8000000 - 8999999

Object Code Segment Minor Range Blocking

The first three digits are called the minor range and identify common grouping for object code summary reporting (example: salaries and wages would be a range within expenses).

Examples:

- Salaries & Wages: 8100000 - 8109999

- Supplies: 8200000 - 8209999

- Travel: 8300000 - 8309999

Find Object Codes

These are just a few examples. You can search a for official object codes by downloading an excel sheet of the entire Object Code list.

Request Object Codes

Download the Object Code Request Form.